Tax Help

Doing your taxes is a pain, but the library can help make it a little easier! During tax season most branches will offer the basic federal and state tax forms in paper format. For online Federal and State forms please see the resources below. If you need one on one assistance we have resources to help with that as well.

Federal Tax Forms

1040

US Individual Income Tax Return

Annual income tax return filed by citizens or residents of the United States.

1040-ES

Estimated Tax for Individuals

Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax.

941

Employer’s Quarterly Federal Tax Return.

Employers who withhold income taxes, social security tax, or Medicare tax from employee’s paychecks or who must pay the employer’s portion of social security or Medicare tax.

Additional IRS Forms

Choose from other popular forms, instructions and publications.

Oregon State Tax Forms

Oregon Department of Revenue

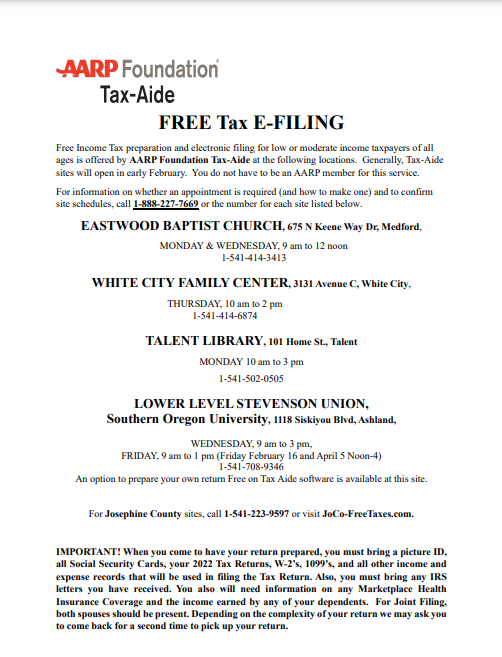

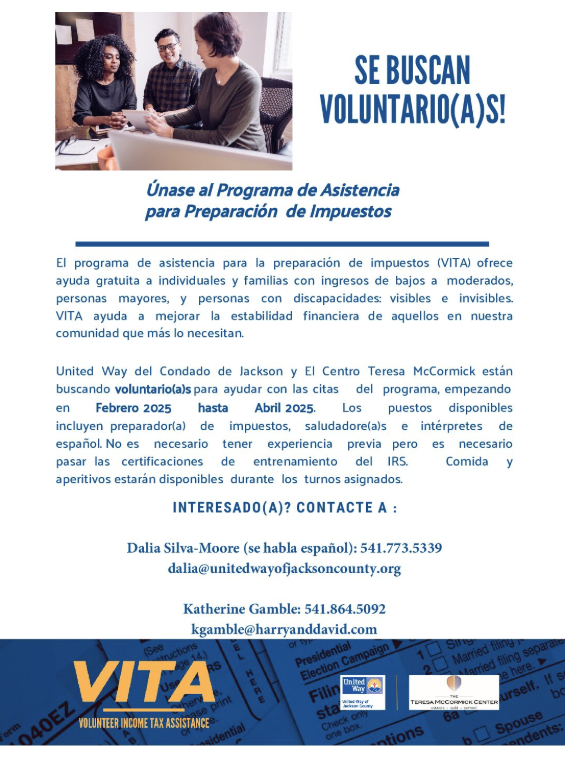

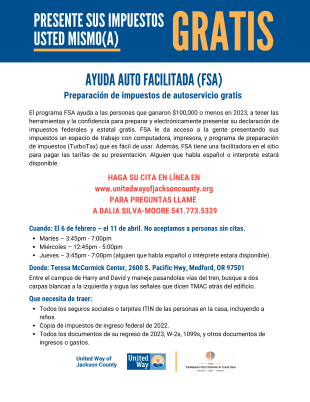

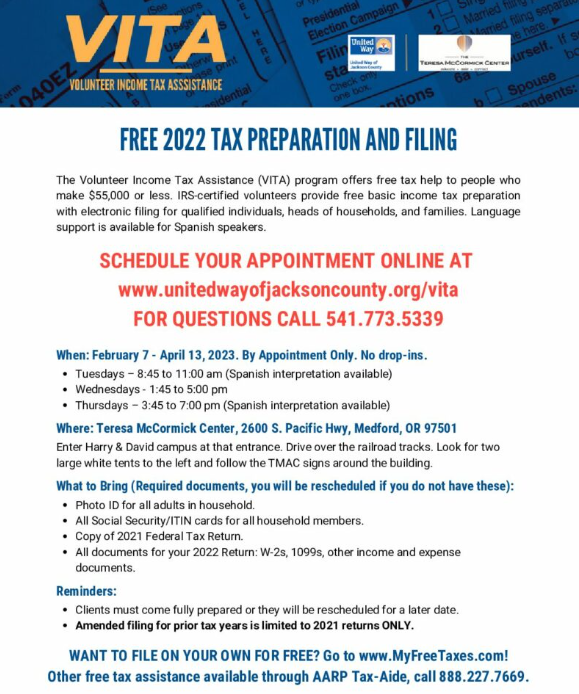

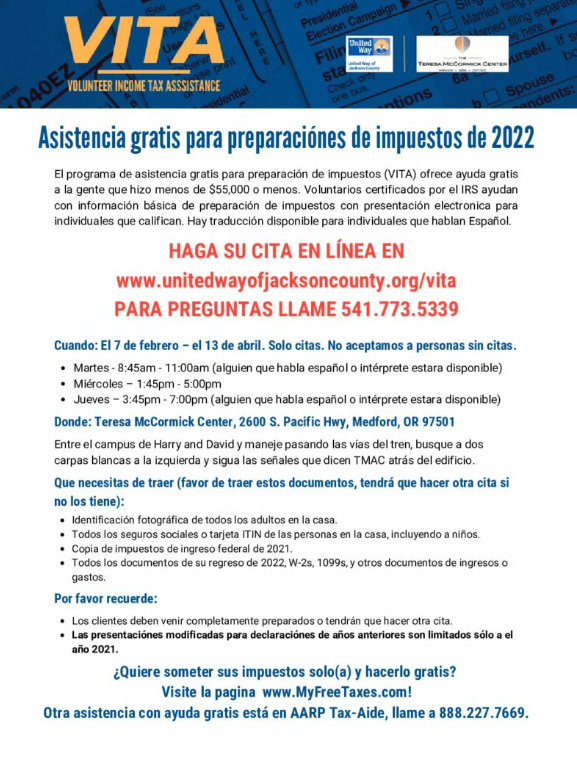

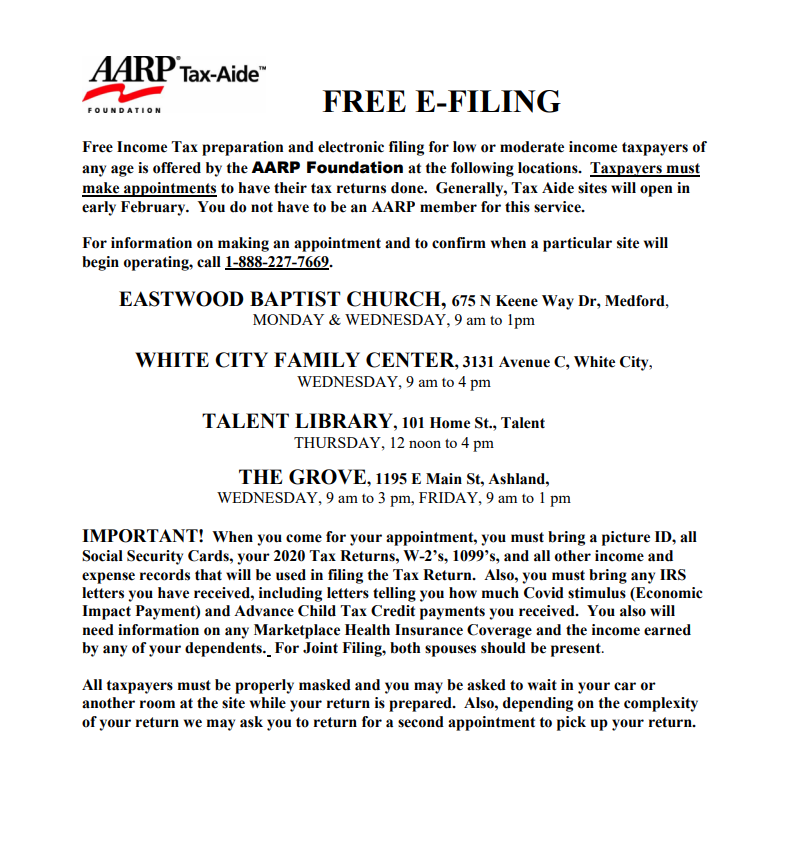

Need in person help?

IRS Tax Assistance Center

Phone: 541-282-1350

OR Dept. of Revenue Office

Phone: 541-858-6500

Forms, publications, and assistance are available through the IRS and Oregon Department of Revenue offices located in Medford. You can order forms and publications from the IRS and Oregon Department of Revenue websites or by telephone.

IRS Forms and Publications:

Website Phone 1-800-829-3676 TTY/TDD 1-800-829-4059

Oregon Forms and Publications:

Website Phone 1-800-356-4222

If you have questions about finding forms, publications, or assistance, you can contact one of the Library’s Reference Centers by email: information@jcls.org